After Opening An RDSP...

After Opening An RDSP...

A. ONGOING RESPONSIBILITIES

Once an RDSP is opened, the Plan Holder(s) have ongoing annual responsibilities.

INCOME TAX RETURNS You will want to ensure that income tax returns are submitted on time each year. If the beneficiary is a child, parent’s returns should be filed. If the beneficiary is an adult, their returns should be filed each year.

MONITOR GRANTS AND BONDS Did you receive the grants and bonds you were expecting from the previous year? Ensure they were deposited. If not the problem may be with tax returns filed two years previously. If tax returns are not filed you will not receive the higher grant levels nor bonds.

CARRYING FORWARD BONDS & GRANTS When carrying forward grant and bond entitlements remember there is a $ 10,500 annual maximum. If you wish to carry forward rants from 2008, it can take 4 years to catch up fully.

AUTHORIZING OTHERS TO CONTRIBUTE If others besides the beneficiary and holder are interested in contributing to the plan you can authorize them to do so by completing the ESDC RDSP ISSUERS FORM available on the ESDC website.

B. DETERMINE AND MANAGE INVESTMENTS

When you contribute to an RDSP, you have an opportunity to also determine how the funds are invested.

BE AWARE OF ALL FEES ASSOCIATED WITH YOUR INVESTMENTS RDSP investments like most other investments have fees attached to them. Make sure you are aware of what you are being charged on each of your investments.

MONITOR INVESTMENT PERFORMANCE In most cases, the performance of your investments will vary year to year. Your financial institution should help you assess your performance each year. If your financial institution isn’t willing to provide that level of service you may consider other options.

KNOW YOUR RISK TOLERANCE Financial institutions are legally bound to help you assess your risk tolerance and to invest in products that are in line with your risk tolerance.

CHANGE YOUR INVESTMENT STRATEGY You may decide to change your investment strategy over time if you are dissatisfied with the growth of the plan.

CHANGE FINANCIAL INSTITUTIONS You also may decide to change financial institutions at any particular time. If you do change financial institutions, pay any service fees in cash and not with withdrawals from your RDSP. If your financial institution withdraws funds from your plan to cover service fees, they may trigger a claw back.

C. CONSIDER YOUR WITHDRAWAL STRATEGY AND TIMELINE

Withdrawals can begin at any age but must begin at age 60. Spend some time now considering the best strategy to begin RDSP withdrawals.

DO YOU UNDERSTAND THE TEN YEAR RULE To ensure that the RDSP is treated as a long term savings vehicle, ESDC has implemented a rule whereby grants and bonds deposited in to an RDSP do not actually belong to the beneficiary until they have been in the RDSP for 10 years. If funds are withdrawn before all grants and bonds have been in the plan for ten years, they will be clawed back at a rate of $3 for every $1 withdrawn.

DON’T LET THE TEN YEAR RULE DISSUADE YOU FROM CONTRIBUTING OR WITHDRAWING With the annual grant and bond maximums, it can take 20 years at the earliest to maximize all entitlements. But don’t let the Ten Year Rule dissuade you from contributing to an RDSP or withdrawing funds when needed. We recommend contributing even if you know grants and bonds will be clawed back. You may change your mind and may delay withdrawals or even if bonds and grants are clawed back, the beneficiary will keep all investments earned on the bonds and grants before the funds are clawed back.

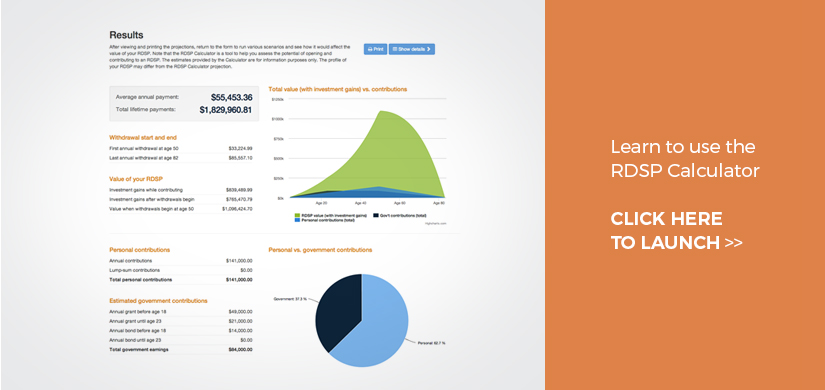

LEARN TO USE THE RDSP CALCULATOR The easiest way to determine when you will want to begin withdrawals is spend time examining your situation with the RDSP Calculator: rdsp.com/calculator/

D. STAY INFORMED

The RDSP will be reviewed by the Federal Government every four years. After the last review, significant changes were implemented and we expect changes after every review. Some terrific sources for RDSP information are:

RDSP.COM

RDSP TOLL FREE LINE (1-844-311-PLAN)

EMPLOYMENT & SKILLS DEVELOPMENT CANADA WEBSITE This site has a wealth of information such as forms you can access, lists of financial institutions offering the RDSP, etc.

GLOSSARY

RDSP: The Registered Disability Savings Plan (RDSP) is a Canada-wide registered matched savings plan specific for people with disabilities.

The Disability Savings Grant: For every $1 put in an RDSP account, the federal government can (if your family income is below $87,123) match with up to $3. This is the Disability Savings Grant.

The Disability Savings Bond: For people living on a low-income (less than $25,356), the federal government will put in $1000 each year for 20 years. This is the Disability Savings Bond.

ODSP: The Ontario Disability Support Program helps people with disabilities who are in financial need pay for living expenses, like food and housing.